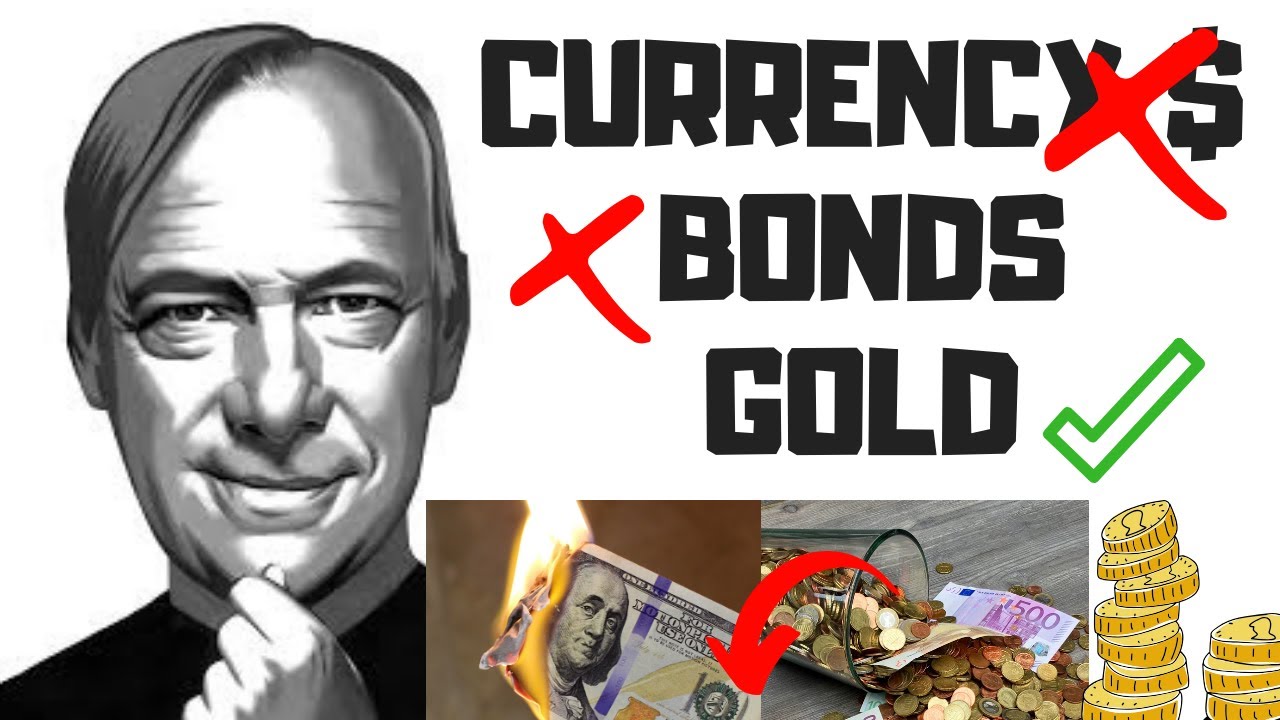

Ray Dalio just published an article from his new book about Money, Credit and Debt. The summary is the following:

Ray Dalio just published an article from his new book about Money, Credit and Debt. The summary is the following: - budged deficits, global debt, corporate debt etc. will lead to currency devaluation as people, companies start to default on it due to the crisis. Governments will bail themselves out by printing, those that can do so due to reserve currency status.

- if and when the printing is too high, the trust is lost and the normal ending of a cycle is a return to hard currencies.

The video explains also in detail how the whole credit cycle works using current examples. The 6 stages of the credit cycle are:

- hard currency

- claims on hard currency

- increase in debt

- FIAT currency

- defaults, devaluation

- back to hard currency

THE MAIN MESSAGE: be prepared for a potential paradigm shift and don't blow up like many bond holders will. The value of money is going down...

Want to know more about my research and portfolios? Here is my independent stock market analysis and research! STOCK MARKET RESEARCH PLATFORM (analysis, stocks to buy, model portfolio)

Sign up for the FREE Stock Market Investing Course - a comprehensive guide to investing discussing all that matters:

I am also a book author:

Modern Value Investing book:

Check my website to hear more about me, read my analyses and about OUR charity. (YouTube ad money is donated)

www.svencarlin.com

Listen to Modern Value Investing Podcast:

I am also learning a lot by interning with my mentors: dr. Per Jenster and Peter Barklin at the Niche Masters fund.

#raydalio #monetarypolicy #economy

0 Comments